Tuesday, March 20, 2018

How to use Google ADMOB

First of all we should know what's google ADMOB

Google Admob is another alternative of Google Adsense and YouTube Adsense where by a user is paid by clicking the ads upon his application and ,This clicking can be of two ways :

1. By Sharing his app to his fans and colleagues or by uploading the app in play store and other App Store, and App exchange click with others .

2. By using Vpn. These vpns are of two (2) type

(A) Free Vpn

(B) Premium Vpn

Using this method of VPN is for those that can't share and upload their app to play stores and This method has merits and demerits .

MERITS

I. It has high earning In terms of Working.

II. You can use many countries and get earning .

DEMERITS

I. It requires technical personal .

II. It's labor is intensive as premium vpns are for sale.

III. If you got catch my Google they will suspend or Disable your account.

REQUIREMENTS FOR GOOGLE ADMOB

I. Android phone version 4 and above .

II. Google Account .

III. FB video Downloader (For Beginners) Download via play store

IV. VPN (For Self Click)Download them via play store DOWNLOAD HERE

V. U C Browser DOWNLOAD HERE

VI. APK EDITOR PRO DOWNLOAD HERE

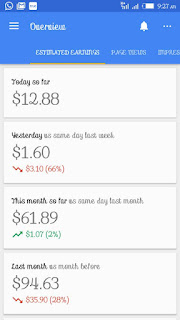

PROVE

To be Continued

Monday, March 19, 2018

What Happens When I Retire?

Health insurance considerations weigh heavily on the

minds of people wanting to retire before Medicare

coverage kicks in at age 65. Many people put off

retirement simply because the cost of an individual

health insurance policy is too great on a limited

income.

What options for health insurance do you have if you

choose to retire before age 65? Although they are not

required to, you may be able to get COBRA-like

coverage from your employer.

As an added retirement benefit, your employer may

allow you to pick up the premium on your policy;

although paying 100% of your premium may initially

appear to be an expensive option, purchasing an

individual policy apart from a group may be even more

costly and not provide you with the level of coverage

you previously had.

Some companies are offering basic high-deductible

insurance reasonably in the hopes that they will be

able to enroll you in Medicare Part C (supplemental

insurance) when you retire.

Another option is to budget and save money to cover

your anticipated medical costs for the time period

between retirement and age 65. If you are in very good

health, this may be a viable alternative for you.

Pre-planning for retirement is an important issue; the

earlier you start planning, the better. Realizing the

Medicare does not pay all of your medical expenses,

you should budget money for medical expenses even

after retirement.

The Importance of Keeping Good Files

As in everything that involves money, it is important

to keep good records of your medical expenses for many

reasons.

Keeping track of deductibles, especially for a family,

can be time consuming, but is an important task. Every

policy has different deductibles for lab work,

hospital emergency room visits, hospital stays, doctor

visits and x-rays, and it is often difficult to track.

Keeping track of your out-of-pocket expenses becomes

very important when it comes time to complete your

taxes. It also comes in handy to know what your

expenses are for medical care when choosing to change

companies or policies.

A file folder that includes a copy of the policy,

copies of your medical bills and copies of what your

insurance company has paid on those bills is usually

all you will need.

When a bill comes for a provider, you will usually

receive a statement from your insurance company

showing what portion of the bill they paid, and many

times providers write off the remainder, if it is not

a large sum.

If you visit several doctors, you may want to have a

file folder for each doctor or provider.

Insurance companies do occasionally make mistakes, but

they are usually on top of their game. Having a copy

of the policy handy makes it easy to check deductible

levels and whether a particular service is covered or

not.

It also serves as a ready resource for telephone

numbers, website information and your contact at the

insurance company.

The Basics

Health insurance, in this modern world of cancer,

heart disease, AIDS, diabetes, asthma, ageing and

other diseases and afflictions, it is essential to

have some sort of health insurance.

There are many levels of health insurance coverage

available; unfortunately, like most things in life,

you get what you pay for, and good coverage can be

very expensive.

The two most common terms in referring to health

insurance are premium, which is the amount paid for

the insurance, and deductible, which is your

out-of-pocket expense before the insurance pays your

provider.

For instance, you might pay $300 premium per month for

family coverage, and your deductible might be $250 per

person, which means if you fell and broke your ankle

and went to the hospital emergency room, you would be

required to pay the first $250 of the bill.

You can purchase very basic catastrophic coverage,

which would carry a very high deductible and the

premium would be less than comprehensive coverage

which would have a higher premium and lower

deductible.

It pays to invest the time to investigate various

insurance options, taking into consideration your age,

your general health and the health of your family

members.

Your employer may offer group health insurance, which

is most likely the least expensive option for you, and

usually the premium is deducted from your paycheck.

Health insurance is a calculated risk; can you afford

the premiums or are you willing to risk that you would

pay less out of pocket for medical expenses in a year

than the premiums would cost? Consider carefully.

Prescription Insurance Policies

Some health insurance policies do not provide for

prescription coverage and a separate policy must be

purchased for prescription medications.

This is an area where it pays to do some homework and

research and find the best policy for you.

Prescription coverage insurance is not a necessity;

like health insurance coverage, it is a calculated

risk, although the risk is not as high.

Usually you can buy prescription insurance at any

time, so if the doctor determines that you need an

expensive maintenance drug, you may opt in at that

time.

It is important to know that if you presently have

prescription insurance you can usually only change it

at a specific time of the year, although you can add

new prescriptions, you can’t change plans.

The person who seldom takes prescription medications

probably does not need prescription insurance;

however, a person who takes maintenance drugs for high

blood pressure, diabetes, depression, heart disease or

immune disorders most likely needs insurance against

the high costs of drugs.

Prescription insurance policies usually have "tiers",

which usually means that a generic drug is at a low or

no co-pay, a tier 2 level may be the brand name

genuine, and a tier 3 may be a brand new expensive

drug that the co-pay could be a set high-percentage of

the cost.

In choosing prescription insurance, you should first

list the prescriptions that you take and the retail

amount of them. If you chose not to purchase

insurance, this would be your monthly cost.

Find out from the provider what the monthly premium

for you would be, then what the prescription co-pay

amount would be and add these two figures together.

Which is the less expensive alternative?

Medicare

Medicare is a governmental program which provides

medical insurance coverage for retired persons over

age 65 or for others who meet certain medical

conditions, such as having a disability.

Medicare was signed into legislation in 1965 as an

amendment to the Social Security program and is

administered by the Center for Medicare and Medicaid

Services (CMS) under the Department of Human Services.

Medicare provides medical insurance coverage for over

43 million Americans, many of whom would have no

medical insurance. While not perfect, the Medicare

program offers these millions of people relatively low

cost basic insurance, but not much in the way of

preventative care. For instance, Medicare does not pay

for an annual physical, vision care or dental care.

Medicare is paid for through payroll tax deductions

(FICA) equal to 2.9% of wages; the employee pays half

and the employer pays half.

There are four "parts" to Medicare: Part A is hospital

coverage, Part B is medical insurance, Part C is

supplemental coverage and Part D is prescription

insurance. Parts C and D are at an added cost and are

not required. Neither Part A nor B pays 100% of

medical costs; there is usually a premium, co-pay and

a deductible. Some low-income people quality for

Medicaid, which assists in paying part of or all of

the out-of-pocket costs.

Because more people are retiring and become eligible

for Medicare at a faster rate than people are paying

into the system, it has been predicted that the system

will run out of money by 2018. Health care costs have

risen dramatically, which adds to the financial woes

of Medicare and the system has bee plagued by fraud

over the years.

No one seems to have a viable solution to save this

system that saves many people throughout the country.

Health Savings Accounts

If you are considering changing your health insurance

policy, you should be aware of the alternative of a

Health Savings Account (HCA).

Health Savings Accounts started to become available

(and legal) in 2004, allowing people with

high-deductible insurance policies to set aside

tax-free money to fund medical expenses up to the

maximum deductible amount.

If you don’t have to use the funds, it rolls over

every year. Once you reach age 65, you no longer are

required to use it for medical expenses, although you

certainly can; you can withdraw funds under the same

conditions as a regular IRA.

Although you will be penalized if you use the funds

for non-medical expenses prior to age 65, you can use

the money for vision care, alternative medicine or

treatment and dental care.

For 2008, an individual may fund up to $2,900 tax

free. The maximum deductible would be $1100 and the

maximum out-of-pocket cost would be $5,600.

For a family, the maximum tax-free contribution is

$5,800 with the maximum deductible of $2,200 and the

maximum out-of-pocket cost would be $11,200.

Health Savings Accounts are certainly a viable way to

shelter income while providing catastrophic insurance

coverage in light of the high cost of low-deductible

health insurance plans.

For healthy people, it deserves some research. Consult

with your insurance agent for all of the details

involving this approach to managing your insurance

needs.

Subscribe to:

Comments (Atom)